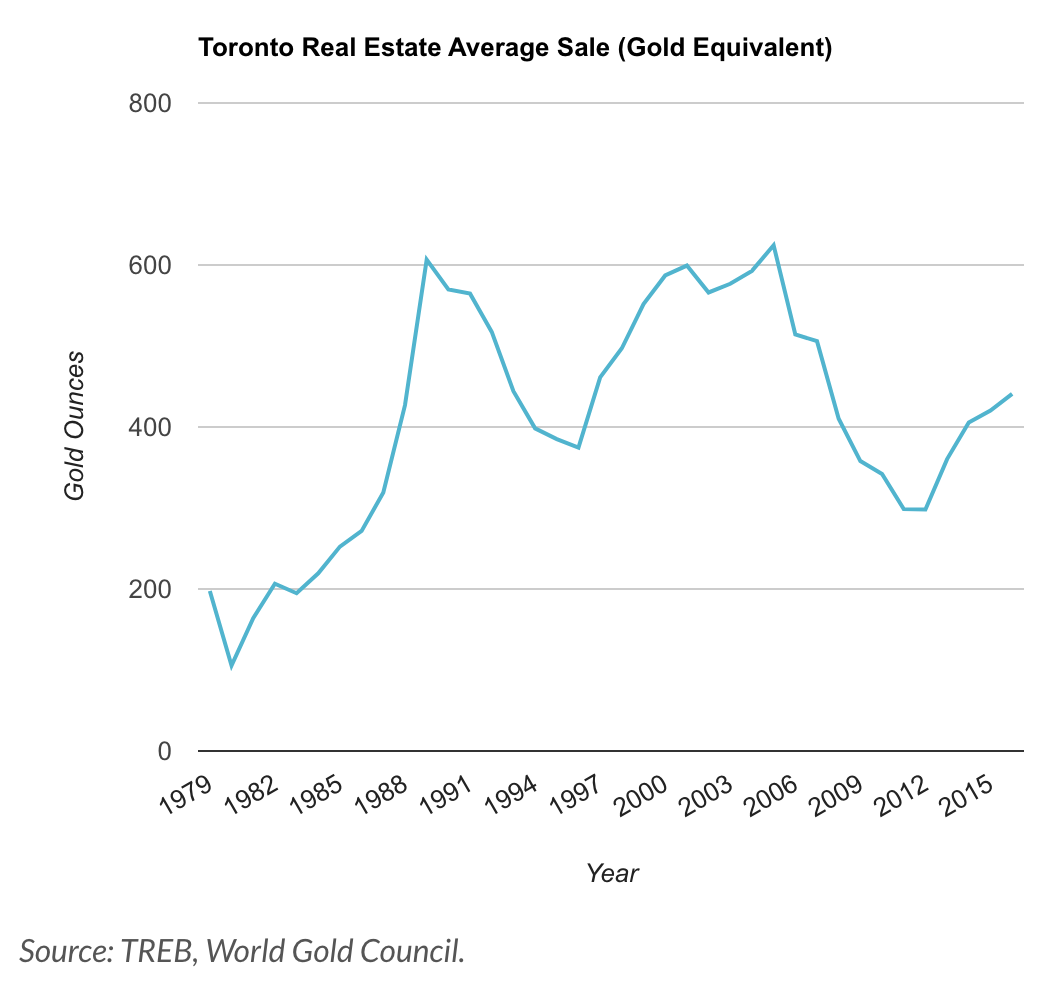

TORONTO HOMES ARE CHEAPER IN GOLD TERMS TODAY VS. A DECADE AGO - SO WHY IS NO ONE CALLING THE GOLD MARKET A BUBBLE?

Jeanette Rodrigues, Bloomberg News

Image courtesty of: Getty Images

Toronto homes aren't that expensive, if you pay in gold.

Douglas Porter, chief economist at the Bank of Montreal, mined data showing that when expressed in terms of gold, house prices in Canada's red-hot real estate market are far from record highs. An average home in Toronto today costs just over 540 ounces of gold, well below the record 655 ounces in 2005, Porter found.

"The slightly more serious point is that gold is again close to a record high in Canadian dollar terms - and no one is calling the gold market a bubble," Porter wrote in a May 26th note.

To be sure, sanity seems to be returning to Toronto's property market. After a double whammy of government intervention and the near-collpase of mortgage lender Home Capital Group Inc., sellers are rushing to list their homes to avoid missing out on recent price gains.

Even so, strong population growth in Canada's financial hub will probably support elevated home prices, Porter wrote. "As will low-low interest rates - while the Bank of Canada indicated it was now more inclined to hike than cut, the hikes still look very far down the road," he said.

Not to mention that Reumpelstilskin - the fairy tale figure who spun straw into gold - could still easily afford to buy into the market.

Post a comment