If you thought Toronto's high home prices would prevent people from moving to the city, think again. According to a new survey, Toronto is the most desirable city to move to for real estate.

The survey was conducted by personal finance comparison site Finder. Based on a poll of 1,200 Canadian adults, Finder found that 54% are willing to move to another city to own a home. Although that's a small majority, the stat proves the Canadian dream of home ownership isn't dead after all.

However, it is interesting that Toronto was named the city of choice for relocation, considering its expensive market. Not only is Toronto rent at an all-time high - one bedroom now costs $2,290 - but house prices are climbing so drastically that not even the U.S. market can keep up.

Unsurprisingly, it's younger Canadians who are the most willing to move for homeownership. The poll found that 85% of Gen Z adults and 70% of millennials are open to moving. This is a significant portion compared to the 57% of Gen Xers (45-54 year olds) and 25% of those over 65.

This is "likely because older Canadians already own their homes or are set in their cities," Finder reports.

A previous analysis by RBC senior economist Robert Hogue supports the survey's findings that young Canadians are willing to relocate.

"For every millennial leaving a major Canadian city for more affordable digs in the same province, there are between 7 and 12 millennials moving in from another country or province," he wrote in April.

Specifically, these millennials are moving to Toronto because the city is a "magnet for young, mobile talent," he added.

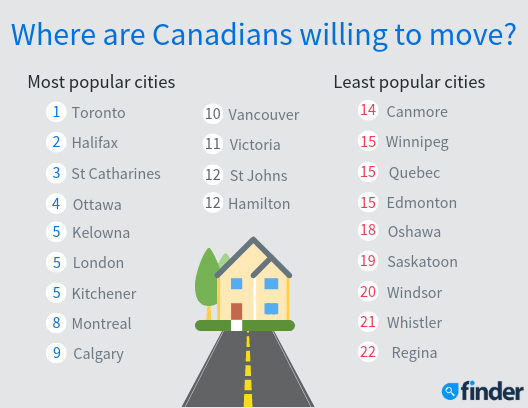

10% of participants in Finder's survey said they'd happily move to Toronto to buy a home. Halifax and St. Catherines rounded out the top three picks, while Regina ranked as the least popular city to move for homeownership.

Investing in Toronto real estate is worth it if you have the funds, according to a MoneySense report. However, it's become much harder for Canadians to enter the market. Not only do high prices and regulations like the mortgage stress test make things more difficult, but it also now takes Canadians - specifically younger Canadians - much longer to save for a down payment.

On average, it takes 13 years for Canadians to come up with 20% of their down payment. This is surprisingly high compared to the five years it used to take back in 1976.

Although this fact can be discouraging, Finder's survey proves homeownership is still on the minds of many Canadians.

Post a comment