Why Analysts See No Quick End to the Toronto & Vancouver Housing Booms

Sunday Dec 13th, 2015

WHY ANALYSTS SEE NO QUICK END TO THE HOUSING BOOMS

In Toronto and Vancouver

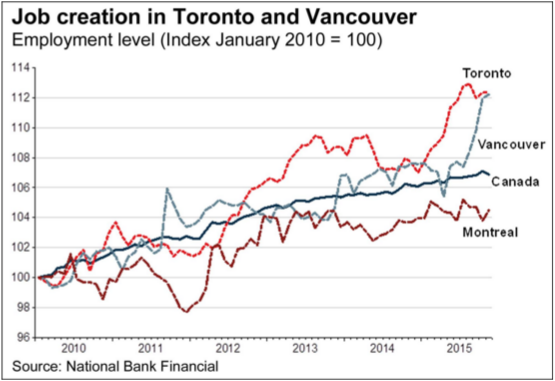

"Job creation has actually been quite strong in Toronto and Vancouver in recent quarters when compared to the national average," chief economist Stefane Marion said.

"Large inflows of permanent immigrants (about 240,000 in the past year) coupled with the misfortune of commodity-producing regions have redirected inter and intra-provincial population migration flows towards Toronto and Vancouver," he added in a research note.

"The good news is that these productive resources have for the most part been absorbed by the job market. So long as this situation endures, home prices in those two cities are unlikely to weaken significantly."

Royal Bank of Canada, too, cited the Ontario and B.C. labour markets in its recent forecast for the provinces, though it also cited the frothy nature of Toronto and Vancouver housing.

In Ontario, employment gains have accompanied rising property values that have fed the wealth effect.

"Although frothy in some areas, ie. Toronto, we believe that the provincial housing market will continue to be supported by strong demand, which will maintain housing construction at historically elevated levels," RBC economists said in the report.

As for Vancouver, RBC questioned how far that market can go, though it doesn't see a pop at this point.

"Annual price gains have accelerated to double-digit rates in markets such as Vancouver and are becoming increasinly unsustainable," the bank said, citing the tight market.

"With upward pressure on borrowing rates expected to emerge in 2016, housing affordability is expected to become even constrained, thereby exerting intensifying downward pressure on home buyer demand, they added.

"Nonetheless, still-tight supply conditions are expected to prevail in the short term and support further property appreciation albeit at a decelerating pace.

And in a new market outlook, local real estate boards projected that average prices across the country would rise next year by 2.5%.

It cited the spectacular average gains this year in the Vancouver and Toronto areas, of 17% of 10% respectively.

"New Canadians and foreign investors continued to be an important demographic of buyers in Toronto, Vancouver and Montreal," it added in the report. "Attracted to Canada's stable economy and low Canadian dollar, this trend is expected to continue through 2016."

Post a comment