Why High Canadian Household Debt Is "Manageable"

Tuesday Jun 28th, 2016

WHY HIGH CANADIAN HOUSEHOLD DEBT IS MANAGEABLE

Canadian household debt has swollen to record highs during a period of low mortgage rates, but an economist with Canada's sixth-largest bank says the debt level is "manageable".

"Analysts often raise alarm bells by pointing to measures such as debt-to-disposable income. But as we often caution, comparing a stock variable such as debt to a flow variable such as income has its limitations," writes Krishen Rangasamy, a senior economist at National Bank, in a recent note.

That's because a stock variable is measured at a specific point in time, whereas a flow variable is recorded over a period of time, Rangasamy explains.

The economist admits "the debt-to-disposible income ratio is high." In fact, it reached 165.4 per cent in Q4 2015, so for every $100 of disposible income Canadians had, they owed more than $165.

But he says the ratio - which was 66% in 1980, according to Statistics Canada - "largely reflects record home ownership rates and the sizeable mortgages that were taken to purchase homes in a resilient housing market."

To see how manageable this debt actually is, Rangasamy suggests looking at it from another angle.

"A flow-to-flow comparison such as interest payments to disposible income is arguably more relevant in gauging how manageable the debt actually is," he says.

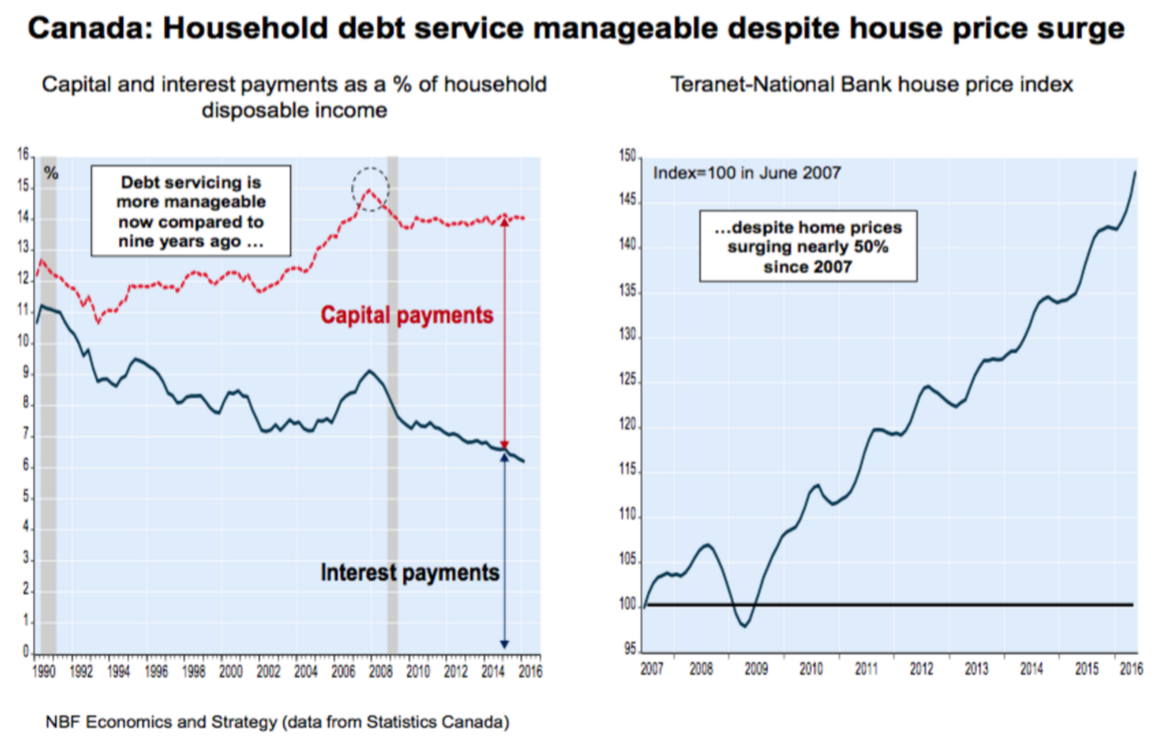

Because of low interest rates, the share of disposable income that Canadians are forking over for interest payments reached a record low of about 6% earlier this year, Rangasamy's research indicates.

"In contrast, capital payments have increased as a share of income, contributing to household wealth accumulation," he explains.

Capital payments include the portion of a mortgage a borrower puts towards owning a home, excluding interest. It's the one that contributes to equity in a home, for example.

"Overall debt service, ie. payment of interest and capital, remains manageable as it accounts for 14% of disposable income," writes Rangasamy. "That's below 2007 levels despite home prices surging about 50% over the last 9 years," he adds.

In 2007, overall debt service as a share of income reached about 15%, before declining for the next few years.

In other words, Canadians are paying a smaller share of their disposable income towards servicing debt despite massive home price gains since.

If 14% is manageable, what would unmanageable territory look like? "Well, that's a good question," Rangasamy replies, in an interview with BuzzBuzzHome News. He says it's relative. "It's hard to pin a number," he adds, noting it depends on various factors including the state of the Canadian economy in general and interest rates in particular.

Rangasamy mentions observers aren't generally calling for a "significant" rate hike, something which could push household debt into unmanageable territory, he says.

A housing market crash and job lossess could also make household debt a problem, the economist says, but he highlights "Canada is still creating jobs."

In May, employment rose 0.6% year-over-year, according to Statistics Canada's latest Labour Force Survey.

"Right now, I think (household debt is) manageable...it's manageable given the state of the labour market - there are jobs still being created - and given interest rates are still low," he says.

Post a comment